Comprehensive AARP Plan Info & Resources

The costs of the AARP life insurance plan

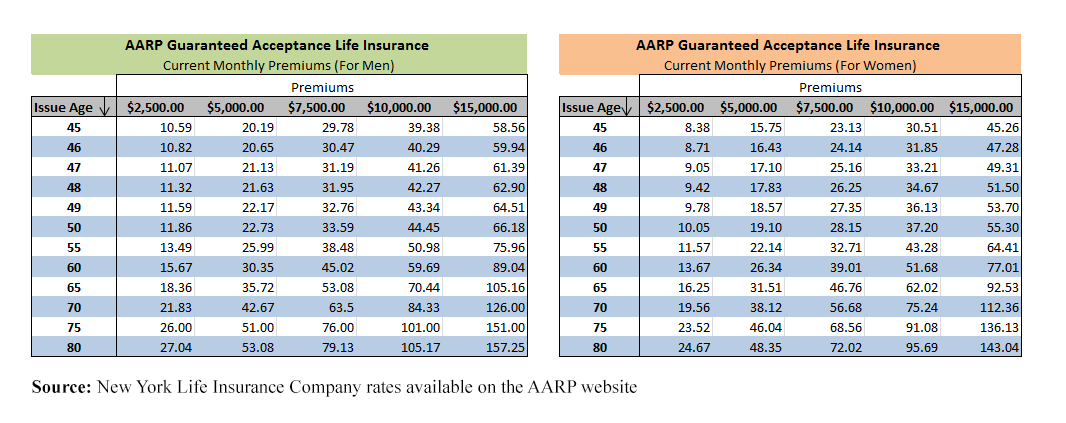

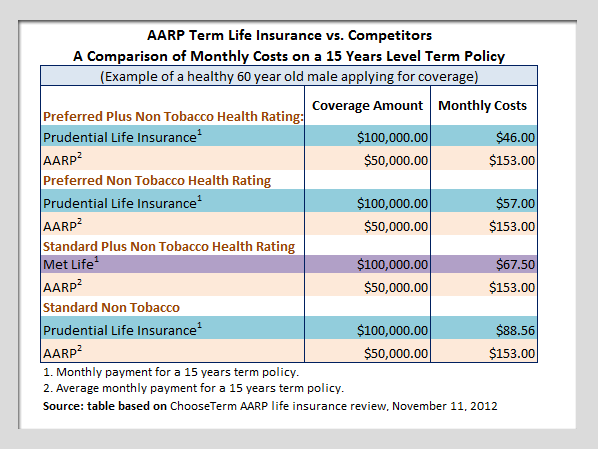

AARP life insurance costs are based on multiple individual variables – assets, expenses, income, inflation rates, expected rate of return – and the AARP Guaranteed Acceptance Life chart displays current monthly rates for this specific type of burial insurance. Elder Law features an article that covers AARP life insurance basics, while the learning center on AARP website includes general info on premium and rates. Choose Term reviews AARP rates based on age issue, Jeff Rose wonders whether AARP is the cheapest way to go and CBS asks if AARP is looking out for you in a feature that details on the costs of the plan.

Laws about the plan:

- While not lacking public controversy because of choice of endorsements of health bills, AARP life insurance falls under the jurisdiction of the U.S. Supreme Court & Federal Health Law. And enters under the IRS’ Life Insurance & Disability Insurance Proceeds.

- Group term life insurance coverage falls under alternate specifications.

- State actions to address Health Insurance Exchanges function as a marketplace of choices for health coverage

- State legislation and actions challenging certain health reforms is the response to the federal health reform law.

Quotes from people or family members of people who have had the plan

Story 1.

I took out a life insurance policy with NYlife/AARP in 2005 on my mother and I paid on it until it gotten to $300.00 a month for a $50.000 policy. I paid the premiums until 2012 and she was not reinstated and I paid close to 8,000 dollars. I was the owner of the policy and beneficiary and they sent by wire transfer to my mother’s account without my knowledge. She had no idea why? But never said anything. I hate this company. They ripped me off for a lot of money.

I would not rate them. Not even 1 star. The customer service and claims need to retire.

Denise, of New Port Richey, Florida (August 2, 2013)

Story 2.

We have had a life insurance policy on my husband for $8,000. The monthly amount was $84. Since 2008, I paid it monthly. Then without notification, they increased the insurance premium due to his age of 75 to $63.87 more a month. That is not only stealing, by taking monies not asked for but increasing premium at such a high amount when we have been religiously paying monthly premiums to this company of $84.00, so they have received over $4,046.40 and now want to increase the premium at such a large increase.

Debbie, of Foley, MO (Nov, 16, 2012)

- More AARP life insurance consumer complaints and reviews are listed on Consumer Affairs

- Pissed Consumer features multiple other AARP life insurance opinion reviews.

Difference between states on the plan

- AARP life insurance rates for MA and MT differ, and in Washington and New York, alternate Permanent Life products are available.

- Oregon residents must be AARP members to request a free Information Kit and Enrollment Form by mail.

- The suicide exclusion applies only for one year for Missouri and North Dakota residents.

- Florida residents can protect against unintended cancellation of their life insurance coverage. A designation form (this is a sample, not the actual AARP form) is included with the Certificate of Insurance.

- Guaranteed Acceptance Life insurance AARP plan is not available in New Jersey and Washington.

With staffed offices in all 50 states, the District of Columbia, Puerto Rico and The U.S. Virgin Islands, AARP in your state lets you access information based on your location.

People who sell the plan

There are more 12,000 New York Life agents, some of which have led the Million Dollar Round Table in membership.

What makes the different people and/or companies that sell the plan different

Definitions about the different parts inside the plan:

- A video covering the basics of AARP term life insurance

- Informative facts: AARP insurance from New York Life

- There are 4 different types of AARP life insurance: the Level Benefit term, the Permanent, the Guaranteed Acceptance plan and the Young Start.

Restrictions of who and who can not be covered by AARP life insurance.

- 3 precautions about AARP Life Insurance

- 4 more precautions about AARP plan

Information on the payout structure of AARP life insurance

History of the plan

- New York Life Company teaming up with AARP seemed like a promise for lifetime income.

History of AARP

Founded in 1958 by Ethel Percy Andrus on the principles of collective purpose, collective voice and collective purchasing power, the American Association of Retired Persons (AARP) originated as a response to the health insurance needs of retired teachers.

About AARP now

- Currently there is a 22 member volunteer based Board, plus an executive team that govern and implement the programs, activities and policies for the (more than) 37 millions members of the Association.

- Their code of conduct details their mission, vision, values for diversity and goals.

- The New York Times has an entire section dedicated to AARP, including commentary and archival articles.

History of New York Life

- New York Life began on April 12, 1845 with a $5,000 policy.

- Now New York Life maintains more than 120 offices throughout the country.

About New York Life now

- Detailed information on the New York Life corporate governance.

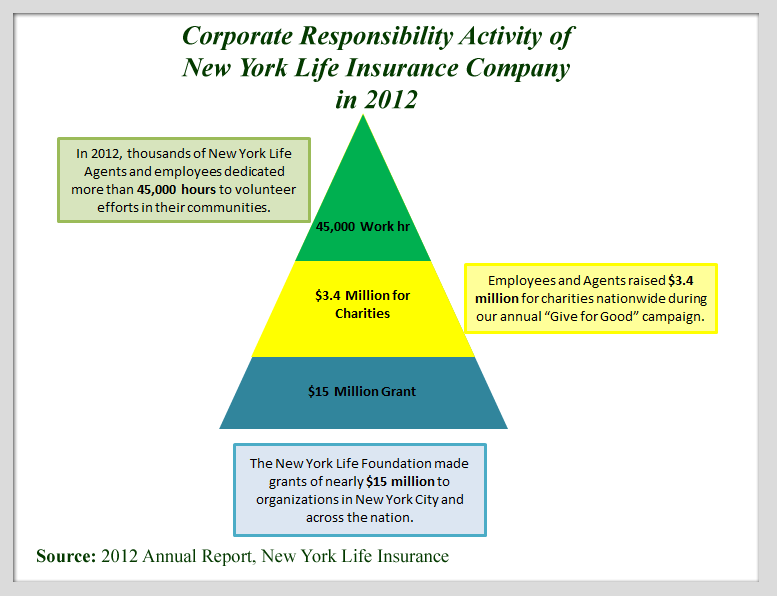

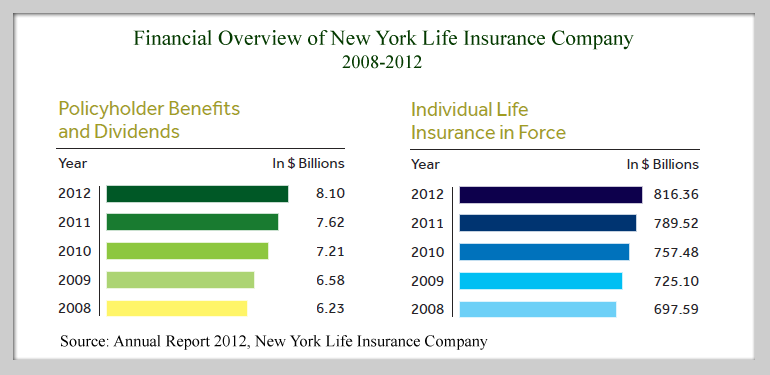

- Financial information for 2010-2012, including the report to policyholders, the New York Life annual report (2012) and the statutory financial information (2012).

- Company commitment reflected in the awards and recognitions page.

The address and information about the offices of where AARP is administered

- Here’s an online form for questions about AARP membership benefits and discount

- General contact information:

- By Postal Mail: AARP 601 E Street, NW Washington DC 20049

- By Phone:

Toll-Free Nationwide: 1-888-OUR-AARP (1-888-687-2277)

Toll-Free TTY: 1-877-434-7598

Toll-Free Spanish: 1-877-342-2277 International Calls: +1-202-434-3525Hours: Monday to Friday: 7 a.m. through 11 p.m. ET

The best phone numbers to get live help from AARP Life Insurance

Talk to a life insurance representative:

Call New York Life at 1-800-865-7927

Monday – Friday: 8 a.m. to 10 p.m. (ET)

Saturday: 9 a.m. to 5 p.m. (ET)Further contacts, via New York Life website:

AARP Certificates: (800) 695 – 5164

AARP Claims: (800) 695 – 5165Office Hours:

Monday – Friday: 8:00 a.m. – 10:00 p.m., Eastern Time

Saturday: 9:00 a.m. – 5:00 p.m., Eastern Time.